Grocers must tailor their business strategies to keep up with consumer demand for a convenient shopping experience

The food and beverage industry is being transformed by growth in e-commerce, however, many grocers see it as the biggest threat to their businesses, according to a survey released today by TD Bank, America’s Most Convenient Bank®.

Grocery e-commerce sales in the U.S. will grow 18% this year, making it the fastest-growing product category online, according to 2019 data from eMarketer. As a result, revenue is expected to surpass $19 billion by the end of the year.

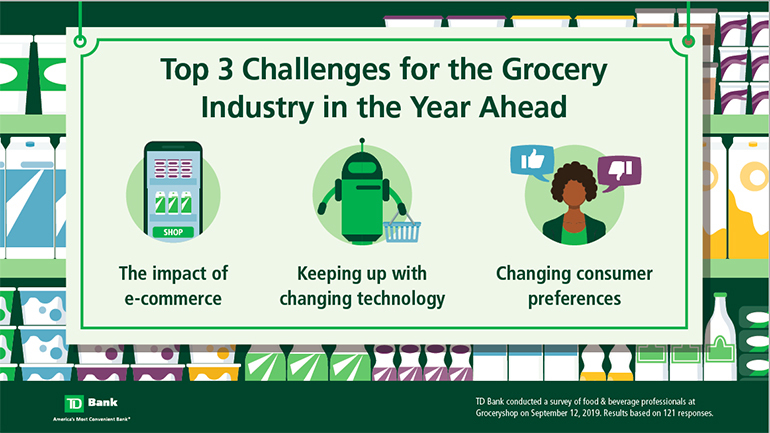

TD Bank’s survey, conducted at the 2019 Groceryshop conference, revealed that many grocers are increasingly worried about this trend. Nearly 30% of respondents ranked new e-commerce channels as the biggest challenge to their business, followed by evolving technology (26%) and changing consumer behaviors (25%).

“E-commerce is rapidly changing the way consumers buy groceries,” said Joseph Nemia, Head of Asset Based Lending at TD Bank. “Traditionally, the industry catered to consumers shopping at brick-and-mortar stores, but this is changing with the use of technology and mobile devices offering options of online ordering, buy-online pick-up in-store and home delivery. To remain competitive, grocers need to invest in channels that deliver speed, convenience and savings for consumers.”

Click on the image to view largerConsumers Demand Convenience

Driven by technology and an on-demand culture, younger generations of consumers have grown up expecting services and products to be available immediately, anytime and anyplace, from top-tier brands. While the need for immediacy is not a new challenge, 57% of respondents feel that convenience shopping will be the biggest consumer behavior to impact their business. Other consumer behaviors perceived to impact businesses include:

- A focus on healthier eating habits (17%)

- Cost-conscious shopping (17%)

- Sustainability and environmentalism (4%)

Grocers Need to Multi-Task

Respondents emphasized the need to be pivotal to accommodate shifts in consumer behavior. While e-commerce has caused considerable disruption, brick-and-mortar continues to dominate the industry, and most respondents (56%) said that online sales represent less than 20% of total sales.

- Grocers were split on where they are making the most investments in delivery services between traditional brick-and-mortar, buy-online pick-up in-store (BOPIS) and online.

- BOPIS narrowly beat out brick-and-mortar and online delivery as the preferred choice for 34% of respondents.

Gearing Up for Growth

While the broader retail industry struggles to adapt to disruption from e-commerce, grocers are still cautiously optimistic about the growth of their market. The majority of respondents expect revenue to grow in 2020, with 76% expecting some form of growth. However, of that 76%, most expected growth to be slow and steady (70%) as opposed to the 30% who forecast significant growth. Interestingly, among the respondents who had started thinking about financing, preparing for growth was a top priority.

“Convenience shopping is changing the way the food and beverage industry operates, but smart grocers are growing and evolving quickly. By thinking proactively about financing and working with financial institutions to maximize working capital, companies are strongly setting themselves up for growth in this ever-changing marketplace,” Nemia said.

Survey Methodology:

TD Bank polled a select group of food and beverage professionals on their views of trends, challenges and changes within the grocery industry at the annual Groceryshop conference in Las Vegas, Nevada from September 16-17, 2019. A total of 121 individuals were polled.

About TD Bank, America's Most Convenient Bank®

TD Bank, America's Most Convenient Bank, is one of the 10 largest banks in the U.S., providing more than 9 million customers with a full range of retail, small business and commercial banking products and services at more than 1,200 convenient locations throughout the Northeast, Mid-Atlantic, Metro D.C., the Carolinas and Florida. In addition, TD Bank and its subsidiaries offer customized private banking and wealth management services through TD Wealth®, and vehicle financing and dealer commercial services through TD Auto Finance. TD Bank is headquartered in Cherry Hill, N.J. To learn more, visit www.td.com/us. Find TD Bank on Facebook at www.facebook.com/TDBank and on Twitter at www.twitter.com/TDBank_US.

TD Bank, America's Most Convenient Bank, is a member of TD Bank Group and a subsidiary of The Toronto-Dominion Bank of Toronto, Canada, a top 10 financial services company in North America. The Toronto-Dominion Bank trades on the New York and Toronto stock exchanges under the ticker symbol "TD". To learn more, visit www.td.com/us.

Media Contact:

Lisa Carlson

TD Bank

Corporate Communications Manager

Email: lisa.carlson@td.com